Understanding Economic Cycles in the Materials Sector

What Wall Street’s AI Hype Isn’t Telling You

Introduction to Economic Cycles and Business Sectors

When talking about business and economic cycles, it’s crucial to understand that the economy isn’t just one big, monolithic entity. Instead, it’s divided into four distinct sectors, each with its own unique cycle dynamics. These sectors are:

Primary Sector: Extraction of raw materials like mining, forestry, and agriculture.

Secondary Sector: Manufacturing, construction, and production of goods.

Tertiary Sector: Services related to the use of goods, like retail and customer support.

Quaternary Sector: Research, education, technology, and innovation services.

By analyzing cycles in these individual sectors rather than broad indices like the S&P 500 or NASDAQ, we gain a clearer picture of the economy’s real health. The broad indices often mask the fact that different sectors can be moving in opposite directions, which leads to volatility and confusion.

Why Focus on the Materials Sector?

In this post, we’ll zoom in on the materials sector, part of the primary sector, which involves extracting resources essential for the rest of the economy. This sector includes companies related to mining, chemicals, metals, and other raw materials.

Why focus here? Because while tech and AI-driven services grab headlines, most people work in materials extraction, production, and manufacturing—that’s the backbone of the economy, often called “Main Street.” Understanding cycles here helps us grasp the real economic trends beyond the hype.

Revisiting Previous Sector Analyses

Before diving into the materials sector, it’s helpful to revisit recent analyses of the secondary sector (manufacturing and production). In my Analysis September/October 2025 “Main Street turned off the lights”, data showed that manufacturing and construction had moved into a negative phase, signaling contraction and recession risk.

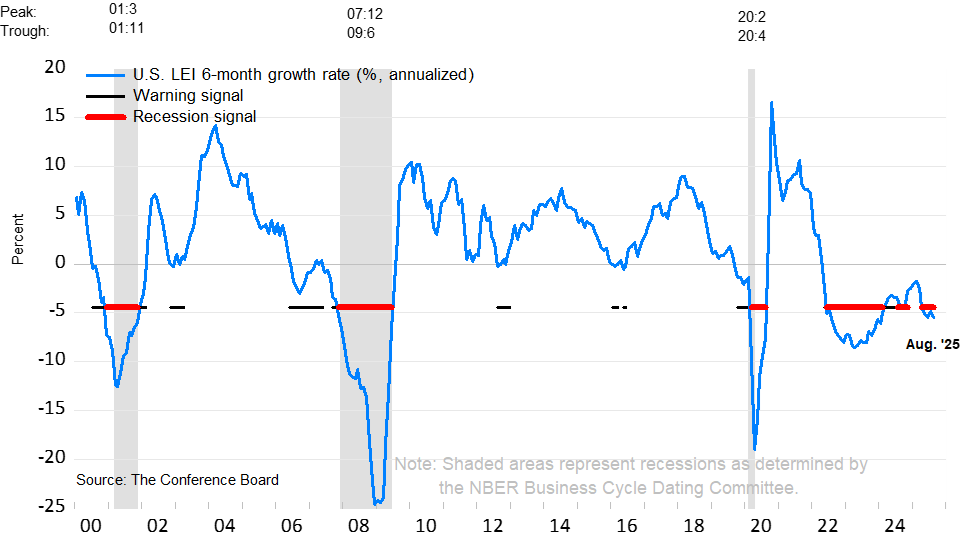

This aligns with leading economic indicators from organizations like the Conference Board, which flagged recession signals in August 2025.

This contraction in manufacturing is important because it sets the stage for what happens upstream in the materials sector.

Long-Term Cycles in the Materials Sector

Looking at long-term data on the S&P 500 Materials index, which tracks 15 to 35 companies in this sector, we spot a very clear dominant business cycle lasting about 182 weeks (roughly 42 months). This cycle has been observed since the 1920s and remains highly stable today.

Peak Timing: The 182-week cycle peaked at the end of 2024.

Current Trend: Since peaking, the materials sector is on a downward trend, with price action showing lower highs throughout 2025.

Cycle Stability: With a stability score of 0.87 (very high), this cycle is reliable for forecasting.

This long-term cycle highlights that the materials sector is currently in a contraction phase, a critical insight often overshadowed by the booming tech sector.

The Tech Bubble vs. Real Economy

While the technology and AI-driven service sectors enjoy growth and excitement, the materials sector tells a different story. The broader indices, heavily influenced by tech giants, may show gains, but the real economy—where materials are extracted and goods are made—is shrinking.

This divergence is vital to understand because:

The tech sector’s growth doesn’t always translate to broader economic health.

Employment and income for many people rely on jobs in materials extraction, manufacturing, and construction.

Ignoring these sectors can paint an overly optimistic picture of the economy.

Short-Term Cycle Analysis in the Materials Sector

Switching from weekly to daily data reveals shorter-term cycles that provide more immediate insights:

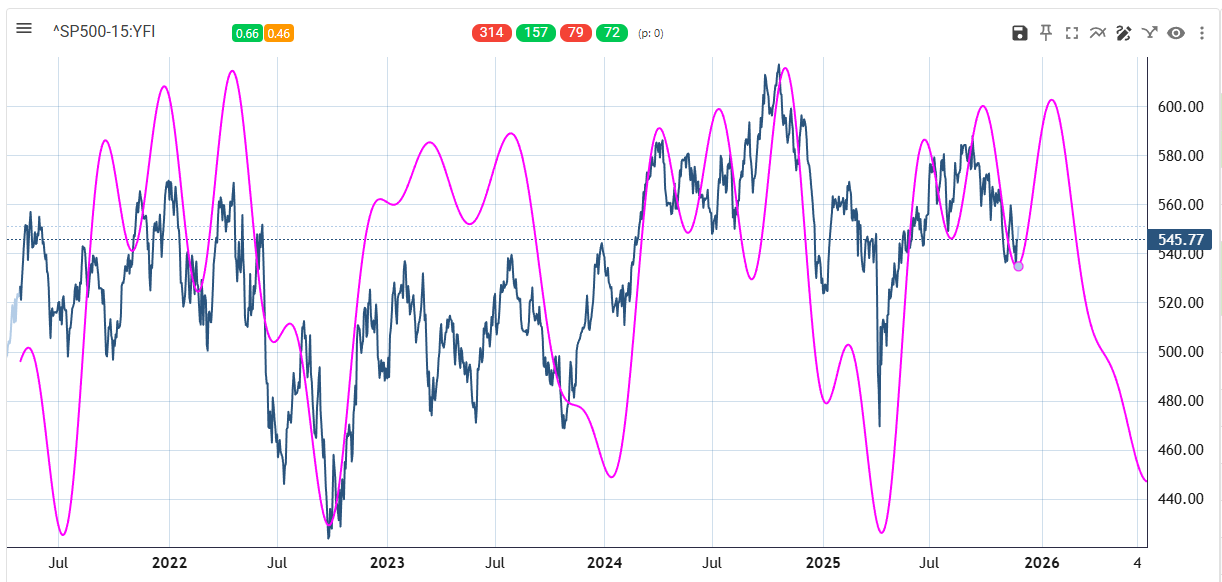

Dominant Daily Cycle: Approximately 314 days.

Other notable cycles: 79 days (short-term), plus mid-range cycles.

Stability is key: Only cycles with high stability scores (above 0.5) are useful for forecasting.

What the Short-Term Cycles Tell Us

There’s a potential short-term upswing or pause in the downward trend toward the end of 2025.

However, all four significant short-term cycles are expected to synchronize their peaks around the end of 2025 or early 2026, signaling a major turning point.

After this synchronized peak, a downward phase is likely in the first quarter of 2026, aligning with the long-term downward trend.

This synchronization is a critical signal for investors and businesses to anticipate tightening economic conditions in the materials sector.

Putting It All Together: What’s Next for the Economy?

Here’s the big picture based on cycle analysis:

Primary Sector (Materials): Contracting since late 2024, with short-term fluctuations but an overall downward trajectory expected through early 2026.

Secondary Sector (Manufacturing & Production): Also contracting, reinforcing recession signals.

Tertiary and Quaternary Sectors: Tech and AI-driven services are booming but represent a smaller portion of employment and real economic production.

This paints a complex but realistic view: the real economy—where most jobs and production happen—is under pressure, even if Wall Street’s tech stocks appear strong.

Why This Matters for You

If you’re an investor, understanding these sector-specific cycles can help you avoid being misled by aggregate indices driven by a few tech giants.

For business owners and professionals, knowing where the economy is headed helps with planning and risk management.

For policymakers and analysts, this sectoral cycle approach provides a more nuanced view of economic health.

What’s Coming in the Series?

This deep dive into the materials sector is just the start. Future episodes will cover:

The tertiary sector (services) to understand consumer-facing business cycles.

The quaternary sector (research and technology) to assess innovation-driven economic trends.

Combining these sector analyses to create a comprehensive business cycle outlook.

Stay tuned for more detailed insights and don’t forget to look beyond the headlines!

Conclusion: Don’t Get Blinded by the Tech Hype

The economy is much more than the AI and tech bubble dominating media coverage. Real economic health depends on materials, manufacturing, and construction.

Regards,

Lars

Cycles TV: For those who are interested in the full cycle analysis video: