ServiceNow - Cycle Status Update

➡️ Recovery / tactical upside phase

Composite Cycle & Technical Outlook Report (No financial advice)

Asset: ServiceNow

Analysis date: 01/12/2026

Focus window: From today (cycle dot) → next composite cycle turn only

1. Composite Cycle vs. Price Behavior (Historical Validation)

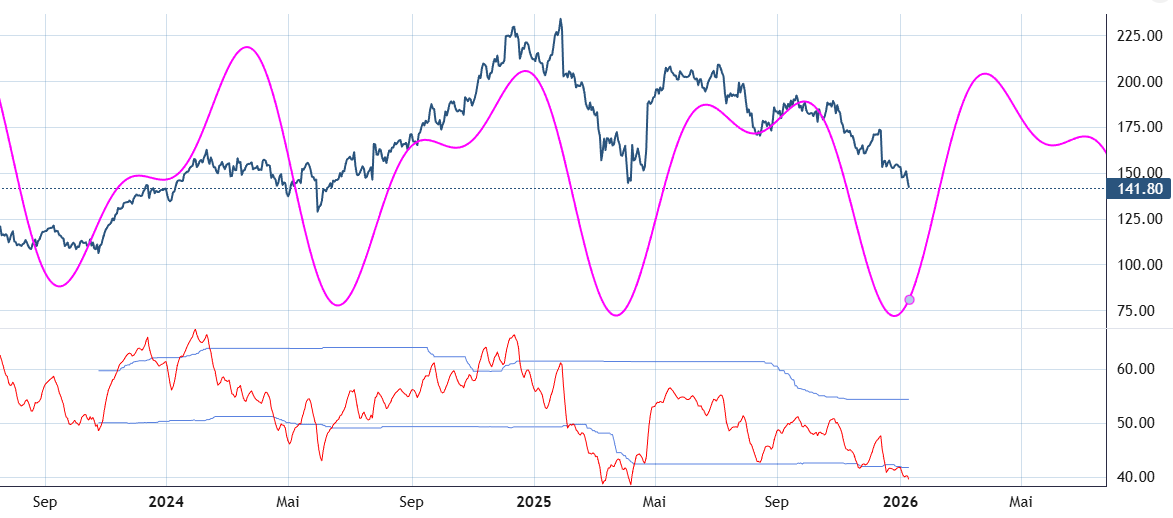

The fuchsia composite cycle has shown strong alignment with major trend changes in the blue price series throughout the in-sample and early out-of-sample periods:

2022–2024: Cycle tops and bottoms consistently coincided with meaningful price reversals, especially at:

Sep 2022 top → subsequent decline

Dec 2022 bottom → sustained rally

Jun 2023 top → corrective phase

Mar 2024 top → consolidation and pullback

2024–2025: The cycle continued to correctly frame medium-term swings, including:

Dec 2024 cycle top near price peak

Mar 25, 2025 cycle bottom preceding a rebound

Jun 23, 2025 cycle top followed by renewed weakness

Overall, the composite cycle has been directionally reliable for turning-point timing, not magnitude, and price has repeatedly respected the cycle’s inflection points.

2. Current Position on the Composite Cycle (Today’s Dot)

Today: 01/12/2026

The small dot marks price positioned just after a composite cycle BOTTOM dated 12/26/2025.

From that low, the composite cycle is now rising, projecting an advance into the next major turn.

🔮 Next Expected Composite Cycle Turn

Date: 03/26/2026

Type: TOP

➡️ From today until late March 2026, the composite cycle implies a counter-trend recovery / upswing phase, even though the broader trend has recently been bearish.

3. Price Action Context at Today’s Dot

Current price (~141.8) is:

Well below the Dec 2024 highs

Below mid-2025 trading ranges

The decline into late 2025 aligns closely with the descending phase of the composite cycle, reinforcing the validity of the recent cycle bottom.

Price is currently depressed relative to prior cycle midpoints, consistent with early-stage conditions after a cycle trough.

4. cRSI Indicator Status (Confirmed Visible)

The cyclically tuned RSI at the bottom of the chart provides important confirmation:

✅ Current cRSI Condition

cRSI: 39.50

Lower band: 41.70

Status: Oversold

Signal Assessment

No upward cross of the lower band yet → no confirmed buy signal

No overbought or sell signals present

No bullish or bearish divergence between price and cRSI:

Price and cRSI are both making lower lows, confirming downside momentum into the recent cycle bottom.

📌 Interpretation:

The market is oversold but stabilizing, consistent with a cycle trough environment, though still in the early phase of recovery.

5. Alignment Between Composite Cycle & cRSI

The composite cycle has just turned up from a bottom (12/26/2025).

The cRSI is oversold, historically a condition that often precedes rebounds.

Although the cRSI has not yet triggered a formal buy signal, its oversold state supports the bullish bias implied by the rising composite cycle.

✅ This creates a constructive alignment:

Cycle: Timing window favors upside into March 2026

Momentum: Washed-out conditions, downside pressure likely diminishing

6. Forward Outlook (Strictly Until Next Cycle Turn)

From today → 03/26/2026:

Composite cycle suggests:

A rising phase toward a cycle TOP

Increased probability of price recovery or counter-trend rally

Expectation:

Volatility may remain elevated

Rallies may initially be corrective rather than impulsive

Risk:

Without a cRSI buy crossover yet, early rebounds could be uneven

📌 No projection is made beyond the March 2026 cycle top, per methodology.

7. Strategy Performance Context (Cycle-Based vs. Long-Only)

Historical results strongly favor the cycle-based approach:

Cycle Swing System

Win rate: 82.35%

Total profit: +285.19

Long-only

Total profit: +63.41

➡️ The swing strategy driven by cycle tops and bottoms outperformed buy-and-hold by +221.77 units, validating the practical usefulness of respecting composite cycle turns.

8. Summary Assessment

The composite cycle has just exited a bottoming phase and is pointing higher into late March 2026.

Price weakness into year-end 2025 matched the cycle’s downswing, reinforcing confidence in the current turn.

cRSI is oversold, with no divergence, supporting a developing recovery but signaling patience for confirmation.

Historically, this combination has favored long-biased exposure during the upswing, with caution as the March 2026 cycle top approaches.

Overall Bias (Until Next Turn):

➡️ Recovery / tactical upside phase, with risk management advised as price approaches the projected March 2026 composite cycle TOP.

© 2026 Lars von Thienen, All Rights Reserved.

Information contained on this site is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. Lars von Thienen “lars.cycles.org” is a publisher of scientific cycle analysis results for global markets and is not an investment advisor. The published analysis is not designed to meet your personal circumstances – we are not financial advisors and do not give personalized financial advice. The opinions and statements contained herein are the sole opinion of the author and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the events that will occur.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decision based solely on what you read here.

Neither the publisher, the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Thanks Lars, this is very valubable commentary for cycle beginners and helps to put things into perspektive and potential trading actions. Would be great if you keep providing context for the upcoming highlighted Assets as well

👍.