S&P 500 Cycles Situation

June 2025

Ladies and gentlemen, market students and seekers of financial truth, let me invite you to pause and feel the pulse of history as it unfolds before us. There are moments in market analysis—rare, electrifying moments—when the cold logic of numbers gives way to a sense of awe, when you realize you are witnessing a convergence of forces far greater than any one of us. That is where we stand today.

This is not just another technical report. It is a message from the very rhythm of the market, a whisper from that “invisible messenger” Dewey spoke of, urging us to pay attention.

We are not isolated traders, each alone at our screens. We are participants in a centuries-old drama, our hopes and fears rising and falling in concert with millions of others. And just as tides are pulled by the moon, so too are markets moved by forces that are often unseen but never unfelt. Today’s analysis uncovers two cycles —clear as a bell, ringing across the decades—hinting that we are approaching a turning point of potentially significance.

Now, let me speak plainly and from the heart. We’ve all felt it: that urge to buy when the headlines are euphoric, to sell when panic is thick in the air. But if you want to prosper, you must learn to step aside from the crowd, to recognize when the music is about to stop.

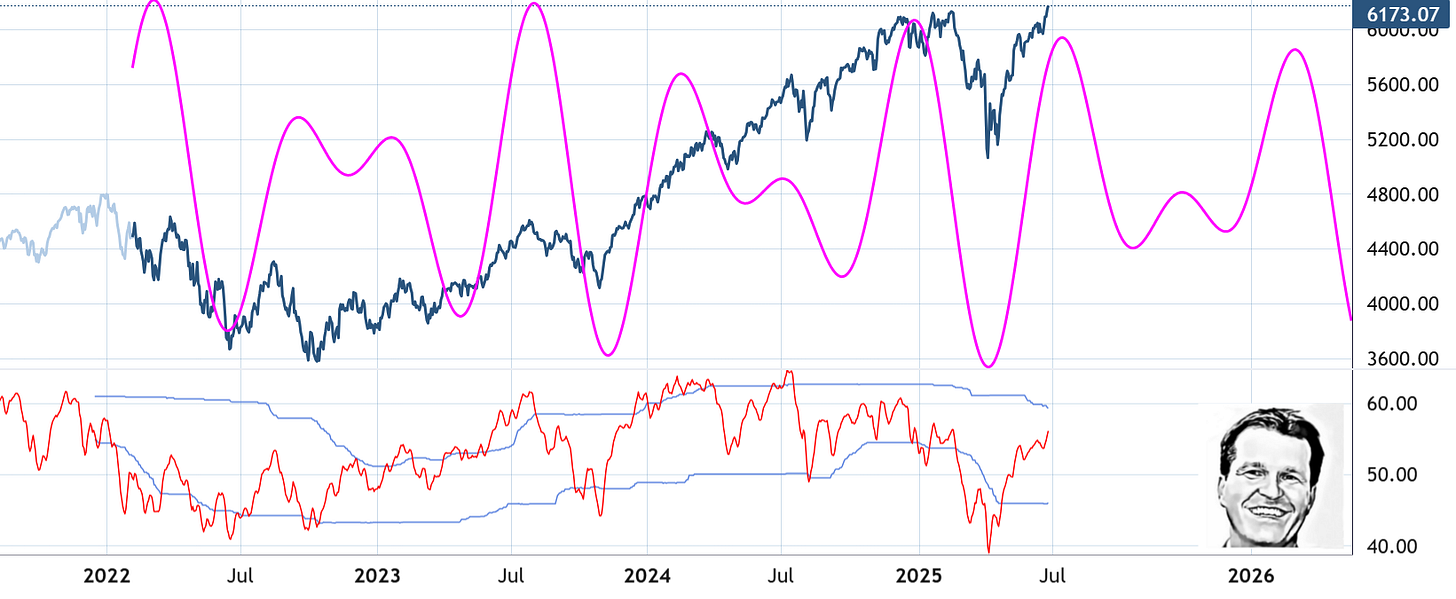

What our analysis shows—what these cycles scream, if you listen—is that the market is nearing a crest. The evidence isn’t just academic; it’s bone-deep, chills-down-your-spine stuff. The composite cycle, which has mapped the market’s swings with uncanny precision, is pointing toward an imminent top around July 10, 2025. The price action and our tuned RSI indicator agree: we’re riding a wave of optimism, but the undertow of change is gathering strength.

If you’ve ever wondered when to act—when to protect your gains or have the courage to buy when others are fearful—this is the moment. The cycle-trading strategy has outperformed by leaps and bounds because it dares to be contrarian, to sell into rising markets and buy into falling ones. It’s not easy. It goes against every fiber of your emotional being. But history—and the numbers—are on the side of those who heed the cycles.

So, as the market races higher, remember: every great party ends. Don’t be the last to leave. Prepare, be alert, and let the wisdom of cycles guide you. Now, let’s first cut through the academic talk before we get to the facts and figures.

Lets Talk straight.

A few years back, I watched a cattle auction in South Dakota. The excitement in the air was electric. Folks were bidding high, laughing, slapping backs—convinced the good times would never end. But the old-timers, they were quieter. They’d seen cycles before: floods, droughts, booms, busts. They knew that just when the barn is fullest, that’s when you’d better start thinking about where the exits are.

This market is a lot like that auction. Right now, everyone’s celebrating new highs, but our cycle analysis—like the wisdom of those old ranchers—says the party’s about to end. The composite cycle isn’t just some fancy tool; it’s your weathervane on the prairie. It’s telling us a storm is coming, likely around July 10, 2025.

And here’s the thing: you don’t need to be a Harvard grad or a Wall Street hotshot to benefit from this. The numbers don’t lie—trading with the cycles has outpaced buy-and-hold by a country mile. But you’ve got to have the guts to act when everyone else is drinking the punch. That’s what separates the pros from the dreamers.

So, as we stand on what may be the brink of a top, let the lessons of cycles—and a little bit of common sense—guide you. Markets are like the seasons. Don’t plant in winter and don’t harvest in spring. And never, ever forget: just when everyone’s sure the sun will shine forever, that’s when you pack your raincoat.

Let’s be ready together—not afraid, but alert, using the tools, the cycles, and the stories of those who’ve walked before us.

Facts & Figures- Cycle Analysis Report S&P500

Financial Analysis Report as of 06/28/2025

Composite Cycle and Price Correlation

The fuchsia composite cycle overlay has demonstrated a strong historical alignment with major turning points in the price series. Past cycle tops and bottoms have consistently coincided with important trend reversals in the S&P 500 price data, as seen for example at the turns in June 2022, January and August 2023, and February 2024.

Current Market Situation (as of 06/28/2025)