Market Cycles Update Feb. 2023

Long-term and short term cycles update

Please find below current cycle charts for the global markets. 2023 will be important in regards to time the expected bottom of the long term model. Audio commentary at the bottom of the post.

» Long-Term Cycles Model - Original Review and Update

Original Cycles Model from October 2021

Summary: Pointing to the major low around May 2023

Updated Long Term Cycles Model - Jan. 2023

Summary: Pointing to the major low around Sept. 2023

Updated Long Term Cycles Model - Feb. 2023

Summary: Pointing to the major low around July 2023

Long Term Model Summary:

We are approaching the bottom of the long term cycles model from 2021 now in 2023. The period between May and Sept. 2023 looks like the long term bottom forming period.

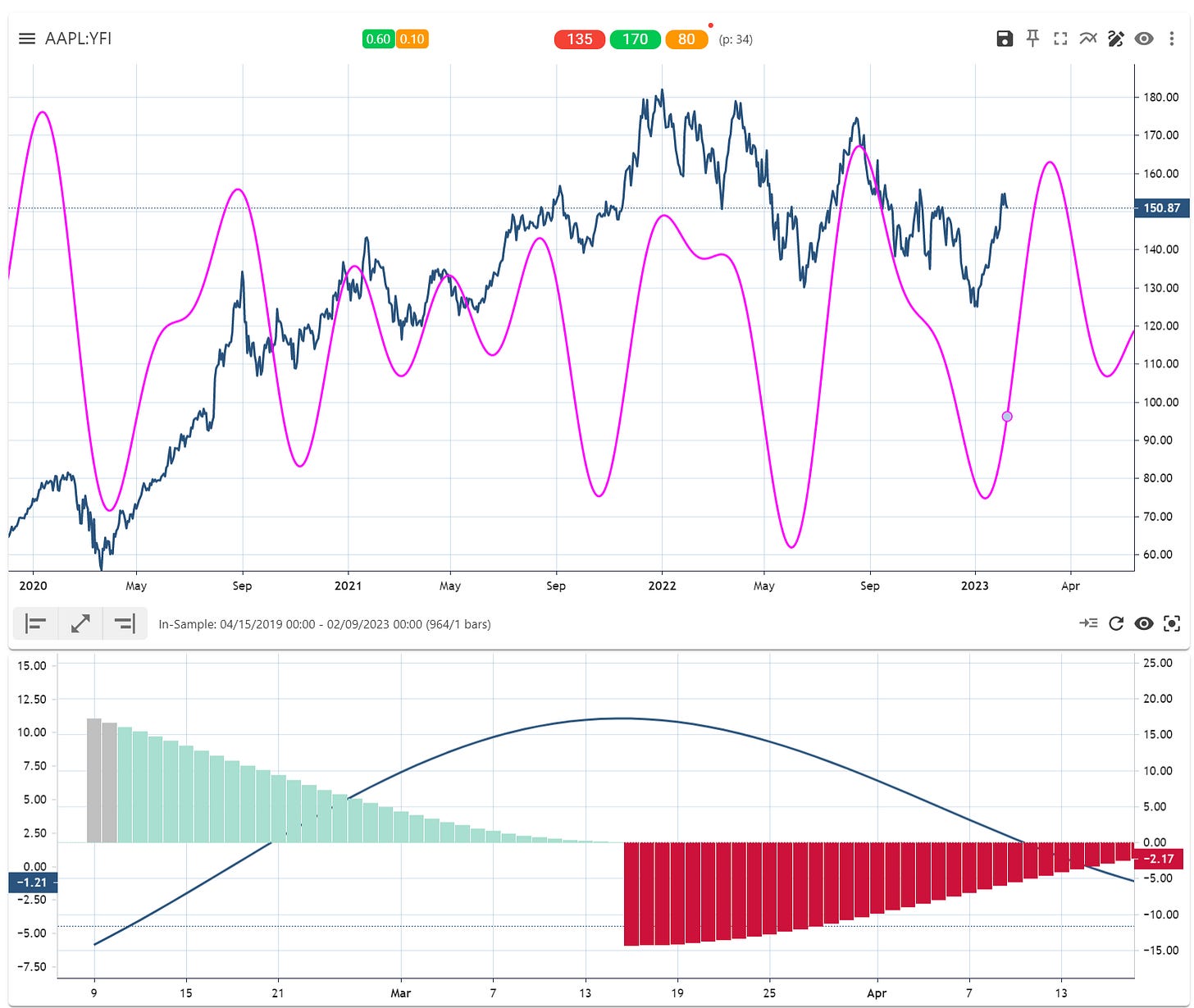

» Apple Composite Cycles Model Update

I am following Apple as proxy for the technology sector since late 2022 with continuous update on the composite model below. The daily model has shown us the bottom from Dec. 2022 ahead of time. Now awaiting a daily top for March 2023.

Interesting to note that the “cycles energy model” (bottom of the chart) has reached its peak and is already declining. So even if the composite model has some time left until the final composite top comes in March, the energy from those cycles is declining now. As Apple has seen a very energetic up-move already, expect the final up move to be more “calm” due to the declining upwards cycle energy.

Daily Apple Model Summary:

The composite model tops out in March, expecting another downward move afterwards. As the composite cycle energy is now declining from its peak, more upward move in price seems to be limited.

» Daily “Technical“ Cycles Update

There is a current daily cycle on the SPX around ~280 trading days, which is topping right now.

Using this dominant cycle to fine-tune our cycle swing indicator, the following technical situation shows up:

The cyclic-tuned RSI is indicating a “sell” signal for the first time again since November 2021. While in parallel we can see a divergence forming between the cycle momentum (bottom) and the price behaviour. Which is a technical bearish situation forming now on the daily chart.

» Overall Summary:

We still expect the bottom of the long-term cycles to be reached in "late summer". So the final low may not yet have been reached. In the meantime, the short-term daily cycles have exceeded their positive momentum from January, and the momentum of the "cycle energy" is already decreasing again. By March at the latest, the daily cycles are also turning negative. The technical cycle-tuned indicators are now showing the first sell signals. The period until March could thus usher in a further downward movement. Be careful if you followed the "cycle long" daily momentum from January.

Regards,

Lars

© 2022 marketcycles.blog, Lars von Thienen, All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher.

Information contained on this site is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. Lars von Thienen “marketcycles.blog” is a publisher of scientific cycle analysis results for global markets and is not an investment advisor. The published analysis is not designed to meet your personal circumstances – we are not financial advisors and do not give personalized financial advice. The opinions and statements contained herein are the sole opinion of the author and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the events that will occur.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decision based solely on what you read here.

Neither the publisher, the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

» Audio commentary for subscribers below »