Financial stress coming into markets

Confirmation & signs of a multitude of cycles rolling into their downward phases

We shared in our last update that we expected weekly and daily cycles to roll to their downward phases.

Here are some charts which are the outcome of this happening.

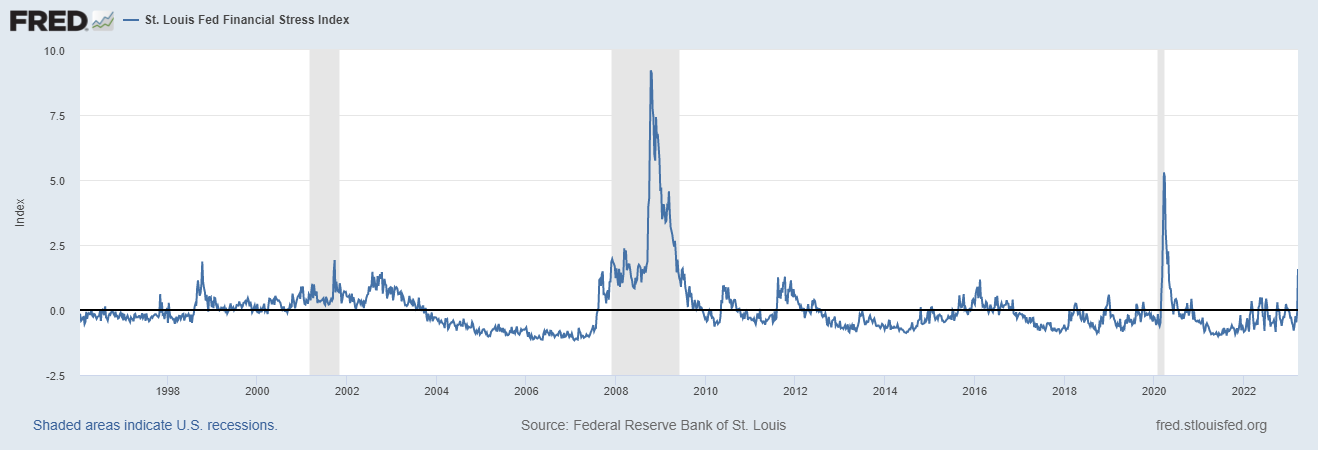

(1) A strong rise in the Financial Stress Index

The Financial Stress Index made a sharp peak with latest data to levels, seen only at the crisis 2000/2001, 2007/2008 and 2020. At each point triggering lower prices by 25%-50% on the global indices.

The financial stress index is shown on an inverted scale in the lower pane. The upper pane shows the S&P500:

FRED raw data - see the current peak with last data point from Friday 17 March:

We projected the following cycle in back in August 2022 for the Financial Stress Index, expected to rise into 2023. That’s exactly what we are seeing now. You can read the original analysis from 2022 here:

This is the updated cycle analysis for the Financial Stress Index. The nominal ~190 days cycle is still visible, approaching its peak in late summer.

Summary:

The financial stress index is on its way up. This is not good news for the equity markets.

(2) S&P500 Equal Weight Index

During the last 2-3 weeks, markets went haywire. Techs leading a “rally”, banks in crisis mode. And technical indicators telling you want you want to see. We are left clueless just looking at the price behaviour of the last 3 weeks.

However, looking at the S&P 500 Equal Weight Index, which is not disturbed by large cap stocks, there are no positive or bullish signs. The EWI is also trading below the December lows and around the lows for the year. Reading this, it is a technical confirmation of our cycle forecasts that the cycles turned down in mid-March.

Conclusion:

You see the cycles rollin’…

AUDIO COMMENTARY » Scroll down to the bottom.

© 2023 marketcycles.blog, Lars von Thienen, All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher.

Information contained on this site is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. Lars von Thienen “marketcycles.blog” is a publisher of scientific cycle analysis results for global markets and is not an investment advisor. The published analysis is not designed to meet your personal circumstances – we are not financial advisors and do not give personalized financial advice. The opinions and statements contained herein are the sole opinion of the author and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the events that will occur.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decision based solely on what you read here.

Neither the publisher, the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.